The Optionality trading platform is exclusively offered by Lightspeed

Options done differently

Optionality is the trading app that empowers you to grow your knowledge by changing the status quo.

We think it’s time that your brokerage did more! We all want a leg up in the market, so we aim to meet you where you are, whether you’re just getting started or have been looking to take your trading to the next level.

4.6

Average App score

Mobile friendly

Global Presence

Spreads

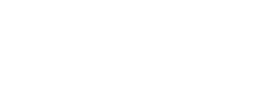

No more confusing options chains!

Utilize algorithms to shop for available trades by expiration. Trades are filtered by max loss and max gain, so you can measure your risk tolerance before placing a trade.

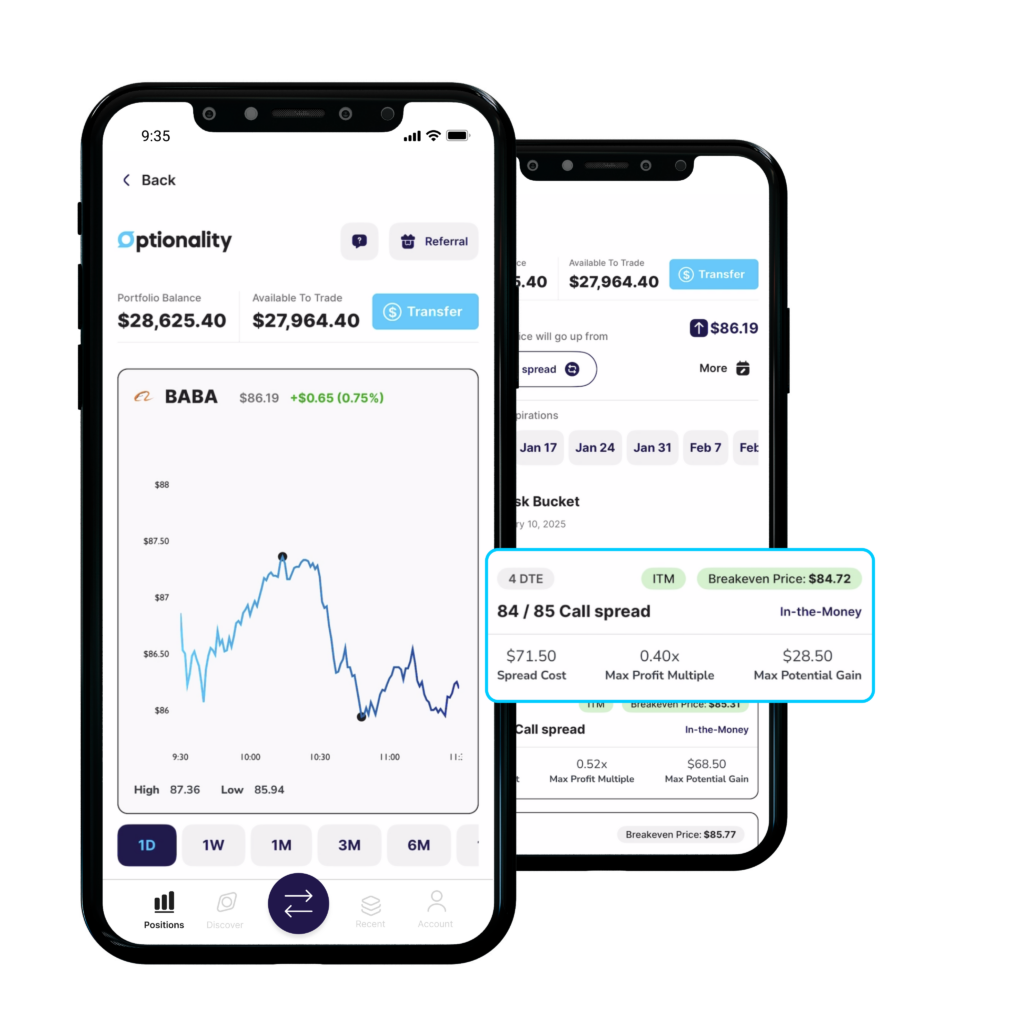

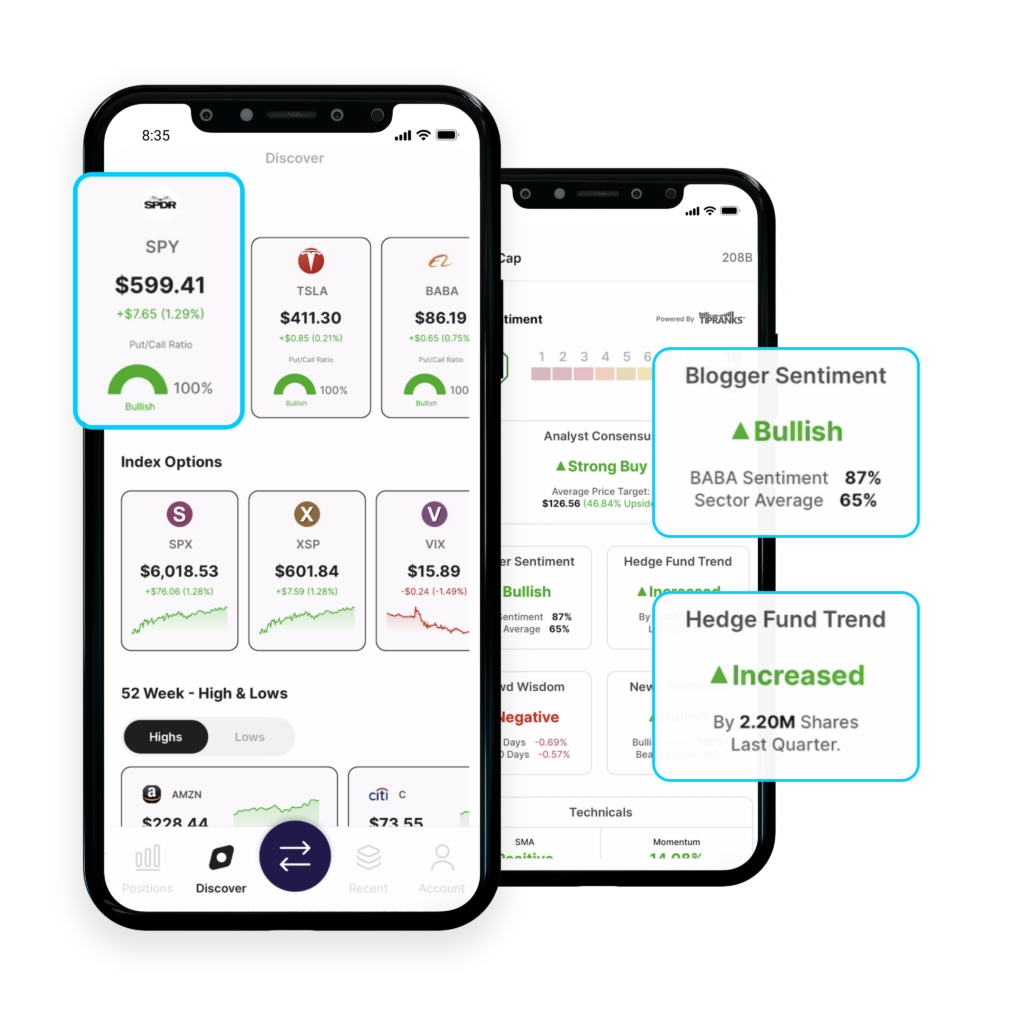

Discover

Navigate volatile markets like never before

You don’t have to trade alone. Access unique market sentiment gauges, trending tickers, and educational data through our Discover tab.

Crowd wisdom

Analyst consensus

Hedge fund trends

Blogger sentiment

Latest news

Ready to elevate your options trading?

Power in your pocket

Look before you leap! Gain transparency into your trading using the Optionality mobile app.

Analysis

See the big picture before placing a trade with our pre-packaged menu, allowing for greater transparency across the options landscape so you can quickly take advantage of a strategy that makes sense for you. Other analysis such as pre-defined risk groupings, Greeks analysis, Volatility measurement, and market sentiment indicators help shape the whole market picture.

Accessibility

Optionality meets the needs of traders of any experience level. Our pre-packaged menus allow even beginning traders to take advantage of the benefits of more complex strategies such as vertical spreads or covered calls, and our OA (Optionality Advanced) platform allows traders to put on complex multileg spreads, write options, and much more.

Join our community of active investors

Tired of antiquated trading solutions and impersonal client experiences? Discover why investors of all experience levels are switching to Optionality.

Trading & Transparency should go hand-in-hand

Discover why Optionality is the future of mobile trading

Regulation

Optionality is offered through Lightspeed Financial Services Group. Lightspeed is a US-based, FINRA registered brokerage.

Reputation

Our clients always come first, and we will continue to place an emphasis on customer support.

Security

Your assets are protected. Lightspeed offers SIPC coverage up to $500,000, of which up to $250,000 can be a cash claim.