About us

Empowering traders through accessible solutions

We’re here to take your options trading to the next level through smarter technology.

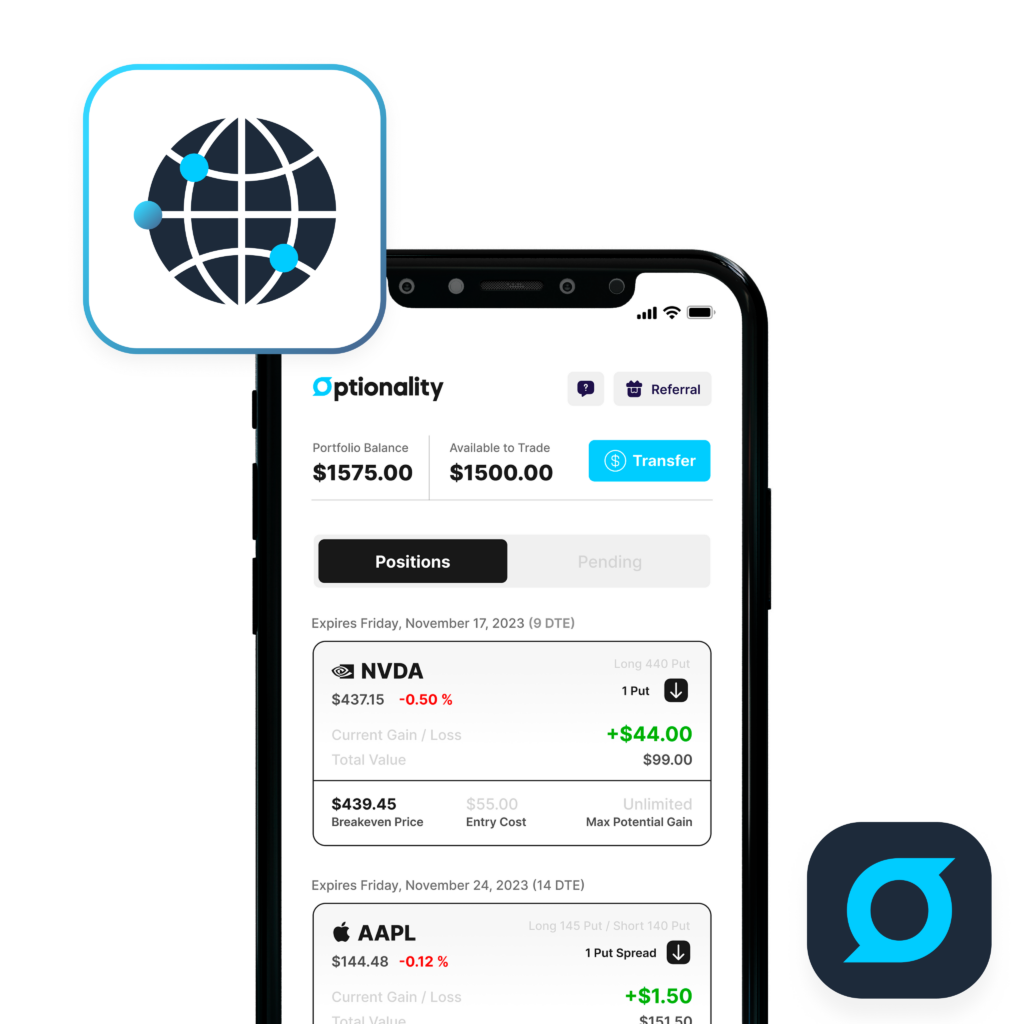

Optionality is the trading platform that empowers you to grow your knowledge and pocket by changing the status quo. We think it’s time that your brokerage did more!

We all want a leg up in the market, so we aim to meet you where you are, whether you’re just getting started or have been searching for a new way to trade.

Optionality was founded in 2020 with the vision of bridging the gap between brokerage and technology, creating meaningful trading experiences for retail investors.

We believe knowledge is power, but you shouldn’t have to do it alone. So we’ve created a mobile trading app designed to filter options trades based on your risk tolerance and affordability. Our platform has unique features so you can learn by doing, instead of sitting on the sidelines

Built for retail traders, by retail traders.

Trusted worldwide

Discover why clients from over 100 different countries utilize the Lightspeed platform suite.

Our story

Transforming options trading

Founded by lifelong friends, Adam and Alec, Optionality was born after recognizing a major disconnect between the modern trader and legacy brokerages, which featured antiquated trading solutions and impersonal client experiences.

Feeling these pain points first-hand and seeing many new traders emerge during the pandemic, they sought to create a more streamlined and modern trading platform that met people where they were, no matter their experience level.

By combining proprietary trading algorithms with a sleek mobile app, Optionality aims to empower traders by enhancing the world of options trading and bringing real accessibility to the market for the first time.

About us

Founder-led team

Alec Baum

Founder

Alec started his career at Susquehanna International Group, which helped fuel his passion for markets and derivatives. The retail trading boom of 2020 provided the opportunity to start Optionality – a retail brokerage focused on options – in an effort to help promote the benefits of more complex options strategies. Alec is a CFA charter holder, holds the Series 7, 24, 4, and 63 FINRA licenses, and holds an MBA from Carnegie Mellon University. Contrary to common belief, Alec was in fact named after Alec Baldwin.

Adam Castelbaum

Founder

After experiencing many of the same frustrations as the new retail investor over the last few years, Adam jumped at the opportunity to create more approachable trading experiences for modern investors. He became obsessed with digesting complex trading strategies that were typically reserved for the elite and bringing them to the masses to create more equitable opportunities through technology. Using his extensive business development and marketing background, he sought to grow Optionality as a ‘client first’ platform to empower retail traders everywhere. Adam had to wear an adult sized bike helmet by the age of four.

Brian Ash

CTO

Part man and part machine, Brian fuels all things technical behind the Optionality app. After having successfully founded and sold three mobile apps prior to Optionality, Brian followed his personal fintech curiosity into the world of options trading. With deep expertise in web & mobile architecture, dev ops, and systems scalability, Brian leveraged his skill set to spearhead the development of Optionality. By his own calculations, Brian is believed to have eaten over 33,000 cashews in his adult lifetime.

From our team

“Optionality is excited to join Lightspeed’s experienced team and its suite of products. Together, we will be able to increase the breadth of our products, offerings, and customer base. We are excited to expand our pre-packaged spread strategies to include more advanced strategies and additional trading instruments”

Alec Baum

Disclaimer: Optionality by Lightspeed. Equities, equities options, and commodity futures products and services are offered by Lightspeed Financial Services Group LLC (Member FINRA, NFA and SIPC). Lightspeed Financial Services Group LLC’s SIPC coverage is available only for securities, and for cash held in connection with the purchase or sale of securities, in equities and equities options accounts. You may check the background of Lightspeed Financial Services Group LLC on FINRA’s BrokerCheck.

All investments involve risk and past performance of any security does not guarantee future results or returns. Please refer to our fee schedule for a complete listing of relevant charges. System response, trade executions and account access may be affected by market conditions, system performance, quote delays and other factors. The risk of loss in electronic trading can be substantial. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business. Optionality makes no guarantee as to the currency, accuracy, or quality of information published and/or archived on the platform, nor will Optionality accept any responsibility for other organizations, businesses, and private persons that provide information on this platform. All information on the platform regarding products and services provided by Optionality is subject to change without notice. Optionality is not responsible for misprints, out of date information, or errors. Optionality does not provide any financial or investment advice.

Terms: “call spread,” “Expires” “positions” “71% positive” (pie chart) “positive snippets” and “negative snippets.”

“*Pre-packaged spreads are option spreads formed by our algorithm and offered as a package.”

“A bull call spread is an options trading strategy designed to benefit from a stock’s limited increase in price. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. The bullish call spread helps to limit losses of owning stock, but it also caps the gains.”

“An expiration date in derivatives is the last day that derivative contracts, such as options or futures, are valid. On or before this day, investors will have already decided what to do with their expiring position.”

“Positive and Negative Snippets are a proprietary output from our partner Stocksnips that aggregated the total amount of media mentions of a certain stock and takes the percentage of those that are positive or negative, as in the example shown above referencing 71% positive”

“As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation.” · “0.50 per contract”

*Options trading involves a high degree of risk and may involve total loss of investment. Options spreads, specifically, offer the benefit of projected maximum gain and loss positions (defined above as “defined risk trades” and “defined outcomes”, but in rare situations may result in gain/loss in excess of the projected cap. Optionality has several mechanisms to greatly reduce these occurrences, but we cannot guarantee they will never happen. For more information on options, Please read Characteristics and Risks of Standardized Options before deciding to invest in options.