What Is a Put Option?

A put option is a contract giving the option buyer the right (but not the obligation), to sell a specified amount of an underlying asset at a predetermined price (“strike price”) before a specified date (“expiration date”).

Put options are traded on various underlying assets, including stocks, currencies, bonds, commodities, futures, and indexes. A put option can be contrasted with a call option, which gives the holder the right to buy the underlying security at a specified price, either on or before the expiration date of the option contract.

KEY TAKEAWAYS

- Put options give holders of the option the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time frame.

- Put options are available on a wide range of assets, including stocks, indexes, commodities, and currencies.

- Put option prices are impacted by changes in the price of the underlying asset, the option strike price, time decay, interest rates, and volatility.

- Put options increase in value as the underlying asset falls in price, as volatility of the underlying asset price increases, and as interest rates decline.

- Put options lose value as the underlying asset increases in price, as volatility of the underlying asset price decreases, as interest rates rise, and as the time to expiration nears.

How a Put Option Works

A put option becomes more valuable as the underlying asset decreases in price. Conversely, a put loses value as the price of the underlying asset increases. Traders utilize put options to speculate on downside price action of the stock.

Investors often use put options in a risk management strategy known as protective puts, which are used as a form of insurance to hedge against losses if the underlying asset does not exceed a certain amount. For these strategies, investors buy a put option to hedge downside risk in a stock held in their portfolio. If or when the option is exercised, the investor would sell the stock at the put’s strike price. If the investor isn’t holding the underlying asset and exercises the put, then they would enter into a short position on the stock.

Factors That Affect a Put’s Price

In general, the value of a put option decreases as its time to expiration approaches because of the impact of time decay. Time decay accelerates as an option’s time to expiration draws closer since there’s less time to realize a profit from the trade. When an option loses its time value, the intrinsic value is left over. An option’s intrinsic value is equivalent to the difference between the strike price and the underlying stock price. If an option has intrinsic value, it is referred to as in the money (ITM).

Option Intrinsic Value is the difference between the Market Price of an Underlying Security and the Option Strike Price. For put options, IV = Strike Price minus Market Price of Underlying Security; for call options, IV = Market Price of Underlying Security minus Strike Price.

Out of the money (OTM) and at the money (ATM) put options have no intrinsic value because there is no benefit in exercising the option at that moment. Investors have the option of selling short the stock at the current higher market price, rather than exercising an out-of-the-money put option at an undesirable strike price. However, outside of a bear market, short selling is typically riskier than buying put options since in general, the stock market goes up.

Time value, or extrinsic value, is reflected in the premium of the option. If the strike price of a put option is $20, and the underlying stock currently trades at $18, there is $2 of intrinsic value in the option. But the put option may trade for $2.55. The extra $0.55 is time value, since the underlying stock price could continue to change before the expiration date. Different put options on the same underlying asset can be combined to form the put spreads available in the Optionality app.

There are several factors to keep in mind when it comes to selling put options. It’s important to understand an option contract’s value and profitability when considering a trade, or else you risk the stock falling past the point of profitability.

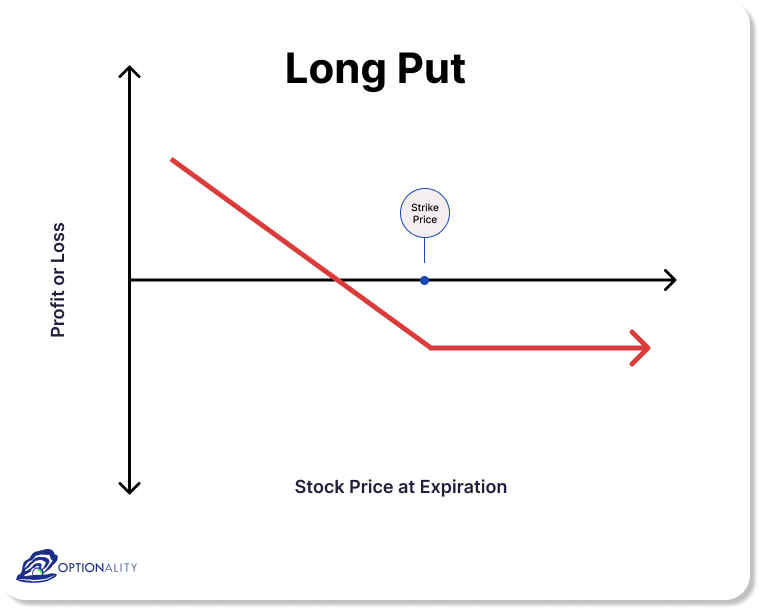

The payoff of a put option at expiration is depicted in the image below:

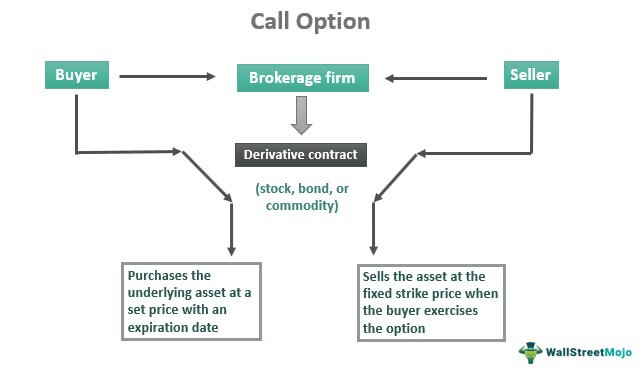

As the value of $MSFT stock goes up, the price of the option contract goes up, and vice versa. The option buyer may hold the contract until the expiration date, at which point they will have one of two choices:

Purchase the underlying stock at a discounted price (strike price)

Sell the options contract at any point before the expiration date at the market price of the contract at that time.

A trader pays a fee to purchase a call option, called the premium. It is the price paid for the rights that the call option provides (i.e. the price to draft the contract and its terms). If at expiration the underlying stock price is below the strike price, the call buyer loses the premium paid. This is the maximum loss.

If the underlying stock’s current price is above the strike price at expiration, the profit is the difference in prices, minus the premium. This sum is then multiplied by how many contracts the option buyer initially bought.

For example, if Apple is trading at $110 at the expiration date, the option contract strike price is $100, and the options cost the buyer $2 per share (or $200 in total), the profit is $110 – ($100 +$2) = $8. If the buyer bought one options contract, their profit equates to $800 ($8 x 100 shares); the profit would be $1,600 if they bought two contracts ($8 x 200).

On the other hand, if Apple is trading below $100 at expiration, then obviously the buyer won’t exercise the option to buy the shares at $100 apiece, and the option expires worthless. The buyer loses $2 per share, or $200, for each contract they bought – equal to their maximum loss

Long vs. Short Call Options

There are two basic ways to trade call options.

Long call option: A long call option is your standard call option in which the buyer has the right, but not the obligation, to purchase the underlying stock at a strike price in the future. The advantage of a long call is that it allows the trader to plan ahead to purchase a stock at a cheaper price. For example, you might purchase a long call option in anticipation of an upcoming event, say a company’s earnings call. While the profits on a long call option may be unlimited, the losses are limited to the premiums on the contracts. Thus, even if a company does not report a positive earnings beat and the price of its shares declines, the maximum losses that the buyer of a call option will endure are limited to the premiums paid for the option.

Short call option: A short call option is the opposite of a long call option. In fact, these are the contracts that traders sell to those who purchase long call options in the above example. In a short call option, the seller promises to sell their shares at a fixed strike price in the future. Short call options are mainly used for covered call strategies by the option seller, or call options in which the seller already owns the underlying stock for their options. The call helps mitigate the losses that they might suffer if the trade doesn’t go their way.

How to Calculate Call Option Payoffs

There are three key variables to consider when evaluating call options: strike price, expiration date, and premium.

These variables calculate payoffs generated from call options. There are two cases of call option payoffs.

Payoffs for Call Option Buyers

Suppose you purchase a call option for company ABC for a premium of $2 per share or $200 in total. The option’s strike price is $60, and it has an expiration date of Nov. 30. Your option will break even if ABC’s stock price reaches $62—meaning the sum of the premium paid plus the stock’s purchase price. Any increase above that amount is considered a profit. Thus, the payoff when ABC’s share price increases in value is unlimited.

What happens if ABC’s price declines below $60 by Nov. 30? Since your options contract is not an obligation, you can choose to not exercise it, meaning you will not buy ABC’s shares. Your losses, in this case, will be limited to the premium you paid for the option, or $200.

Payoff = spot price – strike price

Profit = payoff – premium paid

Using the formula above, your profit is $3 per share ($300 in total) if ABC’s spot price is $65 on Nov. 30.

Payoff for Call Option Sellers

The payoff calculations for the seller for a call option are not very different. If you sell an ABC options contract with the same strike price and expiration date, you stand to gain only if the price declines. Depending on whether your call is covered or naked, your losses could be limited or unlimited. The latter case occurs when you are forced to purchase the underlying stock at spot prices (or, perhaps, even more) if the options buyer exercises the contract. Your sole source of income (and profits) in this case is limited to the premium you collect on expiration of the options contract.

The formulas for calculating payoffs and profits are as follows:

Payoff = spot price – strike price

Profit = payoff + premium

There are several factors to keep in mind when it comes to selling call options. Be sure you fully understand an option contract’s value and profitability when considering a trade, or else you risk the stock rallying too high.

Alternatives to Exercising a Put Option

The buyer of a put option does not need to hold an option until expiration. As the underlying stock price changes, the premium of the option will also change to reflect the recent price movements. The put buyer can sell the option and to minimize loss or realize a profit, depending on how the price of the option has changed since they bought it and how much time is left.

Similarly, the option writer can do the same thing. If the underlying price is above the strike price, they may do nothing. This is because the option may expire at no value, and this allows them to keep the whole premium. But if the underlying price is approaching or dropping below the strike price, then to avoid a big loss, the option writer may simply buy the option back (which gets them out of the position). The profit or loss is the difference between the premium collected and the premium paid to get out of the position.

Example of a Put Option

Assume an investor buys one put option on SPY, which was trading at $445 on January 2022. The strike price is $425 with an expiration date in one month. For this option, put buyer paid a premium of $2.80, or $280 ($2.80 × 100 shares).

If the price of SPY falls to $415 prior to expiration, the $425 put will be “in the money” and will trade at a minimum of $10, which is the put option’s intrinsic value (i.e., $425 – $415). The exact price for the put would depend on a number of factors, the most important of which is the time remaining to expiration. Assume that the $425 put is trading at $10.50.

Since the put option is now “in the money,” the investor has to decide whether to:

(a) exercise the option, which would confer the right to sell 100 shares of SPY at the strike price of $425;

(b) sell the put option and pocket the profit. We consider two cases: (i) the investor already holds 100 units of SPY; and (ii) the investor does not hold any SPY units. (The calculations below ignore commission costs, to keep things simple).

Let’s say the investor exercises the put option. If the investor already holds 100 units of SPY (assume they were purchased at $400) in their portfolio and the put was bought to hedge downside risk (i.e., it was a protective put), then the investor’s broker would sell the 100 SPY shares at the strike price of $425.

The net profit on this trade can be calculated as:

Profit = [(SPY Short Sell Price – SPY Purchase Price) – (Put Purchase Price)] * # of shares

Profit = [($425 – $400) – $2.80)] × 100 = $2,200

What if the investor did not own shares of SPY and the put was purchased as a speculative options trade? Exercising this put option would result in a short sale of 100 SPY units at the $425 strike price. The investor could then buy back 100 shares of SPY at the current price of $415 to close out the short position.

The net profit on this trade can be calculated as:

Profit = [(SPY Short Sell Price – SPY Purchase Price) – (Put Purchase Price)] * # of shares

Profit = [($425 – $415) – $2.80)] × 100 = $720

When you are exercising the option, the notion that you are short selling the shares and then buying them back sounds like a fairly complicated endeavor. However, the investor actually has an easier choice: Simply sell the put option at its current price and make a tidy profit. The profit calculation in this case is:

Profit = [Put Sell Price – Put Purchase Price] × Number of shares

Profit = [10.50 – $2.80] × 100 = $770

Selling vs. Exercising an Option

The majority of long option positions that retain value prior to expiration are closed out by selling rather than exercising. This is typically because exercising an option results in loss of time value, transaction costs/commissions, and stronger margin requirements.

Writing Put Options

Contrary to a long put option, a short or written put option obligates an investor to take delivery, or purchase shares, of the underlying stock at the strike price specified in the option contract.

Assume an investor is bullish on SPY, which currently trades at $450, and does not believe it will fall below $440 over the next month. The investor could collect a premium of $3.45 per share (× 100 shares, or $345) by writing one put option on SPY with a strike price of $440.

If SPY stays above the $440 strike price over the next month, the investor would keep the premium collected ($345) since the options would expire out of the money and be worthless. $345 is the maximum profit on the trade, i.e. the premium collected.

Conversely, if SPY moves below $440 before the option’s expiration date, the investor is on the hook for purchasing 100 shares at $440, even if shares of SPY falls to $430, $400, or anything below $440. No matter how far the stock falls, the put option writer is liable for purchasing the shares at the strike price of $440, meaning they face a theoretical risk of $430 per share, or $43,000 per contract ($430 × 100 shares) if the underlying stock falls to zero. However, if the investor was bullish on SPY in the first place, then perhaps these price movements don’t matter much in the short term. Additionally, they were able to acquire a position in SPY at a discounted price of $440, rather than the original $450 it was trading prior to expiration.

For a put writer, the maximum gain is limited to the premium collected, while the maximum loss would happen if the underlying asset falls to zero. The gain/loss profiles for the put buyer and put writer are thus diametrically opposite.

Is Buying a Put Similar to Short Selling?

Buying puts and short selling are both bearish strategies, but there are key differences between each. A put buyer’s maximum loss is limited to the premium paid for the put, while buying puts does not require a margin account and can be done with limited funds within the Optionality app. Conversely, short selling has unlimited risk and is significantly more expensive because of costs such as stock borrowing charges and margin interest, since short selling generally needs a margin account. Short selling is therefore considered to be much riskier than buying puts.

Should I Buy In the Money (ITM) or Out of the Money (OTM) Puts?

Risk tolerance largely depends on factors such as trading objectives, amount of capital, etc. The premiums for in the money (ITM) puts are higher than for out of the money (OTM) puts because they give you the right to sell the underlying asset at a higher price. The lower price for OTM puts is balanced by the lower probability of being profitable by expiration.

Can I Lose the Entire Amount of the Premium Paid for My Put Option?

Yes, you can lose the entire amount of premium paid for your put, if the price of the underlying asset does not trade below the strike price by the option’s expiration date.

The Bottom Line

Put options allow the holder to sell an asset at a guaranteed price, even if the market price for that security has fallen lower. That makes them useful for hedging strategies, as well as for speculative traders looking to play either side of the market. Along with call options, puts are among the most basic derivative contracts. Explore more within the Optionality app!